Rates were calculated by evaluating our 2021 base profile with the ages 18-60 (base: 40 years) applied. Prices for 18-year-old are based on a vehicle driver of this age that is a renter (not a homeowner) as well as on their own policy.

Washington State presently permits debt as a ranking factor, however a restriction on its use is presently on hold in the courts.

Do I obtain a discount rate if I pay my plan in complete? In a lot of states, customers paying in complete obtain discounts.

insurance companies dui insurance company insurance

insurance companies dui insurance company insurance

If you want discovering an insurance policy representative in your location, click on the "Representative, Finder" web link at any type of time to visit that search tool. vehicle insurance. If you want finding a representative that stands for a particular company, you can likewise click on the company name in the premium contrast which will certainly link you to that company's internet site.

If someone has an existing insurance plan with AAA (or any type of various other insurer), they have a 14-day to 30-day grace period to insure their brand-new automobile, depending on the kind of plan. Nevertheless, if a specific acquisitions a new vehicle as well as has never had an insurance policy in the past, they need to buy insurance prior to they drive off the whole lot.

Not known Facts About What Determines The Price Of An Auto Insurance Policy? - Iii

Just log in and also, on the residence web page, scroll down to Account Actions. Simply underneath that, under Insurance, click on "Pay Your Insurance coverage.".

Insurer supplement that info by gathering big quantities of data from consumer insurance claims. Safer lorries are often less costly to insure, as well as insurance firms often provide price cuts to consumers driving more secure autos. Meanwhile, some insurance companies enhance premiums for cars and trucks that have poor security documents and are extra vulnerable to damage or passenger injury - cheapest car.

The longer an insurance business guarantees a type or model of automobile, the more information it needs to figure out fair prices. If the automobile has constructed a solid record over numerous years, odds are it will certainly insure at an affordable rate, and also remain steady gradually. Alternatively, vehicles with inadequate safety background or those that are a favorite target for thieves will certainly be more expensive to guarantee.

cheap car car insurance low cost auto cheap insurance

cheap car car insurance low cost auto cheap insurance

Insurer have actually located that past efficiency frequently does foretell future outcomes. If you have actually had speeding tickets or crashes, or various other violations within the last couple of years, your auto insurance coverage price might be more than if you have a spotless driving document. cheapest car insurance. Just how much you drive, Are you a roadway warrior, or a homebody? The difference will certainly show up in your premium rates.

insurance affordable low cost insurance cheapest car insurance

insurance affordable low cost insurance cheapest car insurance

It simply makes sense, the even more time on the road increases the opportunities of being involved in a crash or enduring damage to your automobile. Size matters, You may believe smaller vehicle, smaller insurance coverage premium.

The Best Car Insurance Companies Of May 2022 – Forbes Advisor Statements

Anti-theft devices, If your cars and truck has an https://storage.googleapis.com alarm system, a tracking gadget to help cops recoup it, or another burglary deterrent, it's less eye-catching to thieves, and also less costly to guarantee, too. Your credit report, Study has shown that great credit history is linked to good driving and also vice versa. Specific credit history information can be predictive of future insurance policy cases.

The bottom line: Good credit history can have a positive influence on the expense of your vehicle insurance coverage. cheap auto insurance. Insurance policy rates in a lot of states mirror these differences.

Where you live, Usually, as a result of greater rates of vandalism, theft, and collisions, urban vehicle drivers pay even more for auto insurance policy than do those in villages or backwoods. You likely can not quickly change where you live, but if you do stay in a high insurance location make sure to pay very close attention to the other factors that you can control.

By doing some homework in advance concerning possible auto insurance prices, you can make an informed decision to make certain you have the right auto at the ideal price of having it. See if ERIE can Offer a Cheaper Vehicle Insurance Policy Rate, Ready to get more information regarding cost effective vehicle insurance policy from ERIE? Check out our and also start an automobile insurance policy quote today. auto insurance.

An automobile insurance plan can consist of several various kinds of insurance coverage. Your independent insurance policy representative will provide professional recommendations on the type as well as amount of car insurance protection you need to have to meet your individual needs and also follow the legislations of your state. Here are the major kinds of coverage that your policy may include: The minimum coverage for physical injury varies by state and might be as reduced as $10,000 per individual or $20,000 per mishap.

Little Known Questions About How Much Is Car Insurance? These Are The Average Costs.

If you harm somebody with your automobile, you might be demanded a lot of money. The amount of Liability coverage you bring must be high sufficient to safeguard your assets in the occasion of a mishap. The majority of professionals recommend a restriction of a minimum of $100,000/$300,000, but that may not be sufficient.

If you have a million-dollar residence, you could lose it in a lawsuit if your insurance protection is inadequate. You can obtain added insurance coverage with an Individual Umbrella or Individual Excess Responsibility plan. The better the worth of your possessions, the much more you stand to shed, so you need to acquire obligation insurance ideal to the value of your assets.

You do not have to figure out just how much to buy that depends on the vehicle(s) you insure. The greater the deductible, the reduced your premium will be.

If the automobile is only worth $1,000 and the deductible is $500, it may not make feeling to buy crash protection. Collision insurance is not usually needed by state regulation.

Comprehensive coverage is normally offered along with Collision, and both are commonly referred to with each other as Physical Damages coverage. If the automobile is leased or funded, the leasing company or lending institution might need you to have Physical Damage protection, also though the state regulation might not require it. Covers the expense of medical treatment for you and also your travelers in the occasion of an accident. auto insurance.

The 15-Second Trick For Full Coverage Car Insurance Cost Of 2022

Consequently, if you pick a $2,000 Medical Expenditure Limitation, each passenger will certainly have up to $2,000 coverage for clinical cases arising from a mishap in your car. If you are associated with a mishap and also the other chauffeur is at fault yet has also little or no insurance, this covers the space between your expenses as well as the various other vehicle driver's coverage, up to the limits of your insurance coverage.

The restrictions required and also optional limits that may be offered are established by state regulation (auto insurance). This coverage, required by regulation in some states, covers your medical expenses as well as those of your guests, no matter who was in charge of the crash. The limits required and also optional limitations that might be readily available are set by state regulation.

Right here are a few of the very best approaches that you can utilize to reduce your costs. Maintain A Safe Driving Record The much safer you drive, the lower your insurance will certainly be (auto). Mean you can avoid any kind of crashes (at-fault or not-at-fault) and also avoid web traffic tickets (reckless driving, speeding, and so on) that put factors on your license for numerous years each time.

Elevate Your Credit report The majority of insurance firms check out your charge account's economic toughness and use it to establish your monthly premium prices. Among the easiest ways to lower your GEICO automobile insurance policy rates is to raise your credit history, make every one of your payments promptly, as well as stay clear of any type of liens on your car whatsoever expenses - cheap insurance.

Relocate To One more City The closer you live to a huge city, the much more you'll pay. By moving out to the suburban areas or into the country, you might receive a significant price cut on your regular monthly automobile insurance coverage prices.

Some Of How Much Does Car Insurance Cost? - Experian

automobile prices auto vehicle

automobile prices auto vehicle

Sirijit Jongcharoenkulchai/ Eye, Em, Getty Images Just how much you must spend for car insurance varies commonly based upon a selection of elements. Location is generally the most important element for risk-free vehicle drivers with decent credit history, so it helps to comprehend your state's averages. The nationwide standard for car insurance coverage premiums has to do with $1621 per year, and there are states with averages away from that figure in both instructions - automobile.

Ordinary National Prices, The overall nationwide ordinary expense of vehicle insurance policy will certainly vary based on the source. insurance. That $1621 a year number originates from Nerd, Purse, while The Zebra puts the average costs more detailed to $1502 each year. Whatever the instance may be, you'll most likely find on your own paying more than $100 each month for automobile insurance.

When determining nationwide prices, a selection of factors are included. Numerous insurance coverage choices are readily available from insurance business, and the typical number needs to show the most typical type of protection. In this case, the nationwide cost figures gauge policies that consist of liability, thorough, as well as crash insurance along with state-mandated insurance coverage like individual injury security and also uninsured motorist insurance coverage (insurance companies).

Usually, the minimum insurance will set you back concerning $676 each year, which is almost $1000 less than the nationwide average each year. While these standards can be useful for obtaining an idea of what insurance coverage prices, your personal variables have one of the most effect on the costs prices you'll get. Typical Coverage Level, Generally, individuals tend to select even more protection than the minimum that's legitimately required.

On standard, full insurance coverage will certainly set you back not also $900 annually. North Carolina as well as Idaho are likewise notable for offering economical complete coverage. One of the most pricey state for insurance coverage is Michigan, as well as its ordinary costs are far past the national standard. For full protection in Michigan, you'll be paying over $4000 annually, though there are initiatives to reduce this price. insurance companies.

An Unbiased View of What Determines The Price Of An Auto Insurance Policy? - Iii

Factors Impacting Your Costs, How much you should be paying for your costs is mostly influenced by differing individual elements in addition to your details location. While any type of aspect can indicate just how much of a risk you will certainly be to insure as a motorist, one of the most crucial aspects are normally the exact same throughout all insurer, though there are exemptions (insurers).

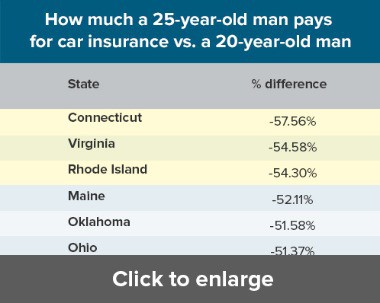

Minimum state-required coverage will certainly always be one of the most budget friendly, however if you plan on marketing your vehicle at a later day, extensive insurance coverage might be a personal requirement. Age: Age plays a big role in exactly how much your premium is. If you more than the age of 25 with a tidy history, your premiums will mostly be the very same for decades.

automobile cheaper car trucks vehicle insurance

automobile cheaper car trucks vehicle insurance

Teenagers are specifically costly to cover, as they present the most take the chance of due to their lack of experience. Time on the road: The more time you invest in the road, the higher your premiums are mosting likely to be. This results from the sheer opportunity of entering a crash being raised compared to individuals that don't drive as much.

This is only real if you go with thorough and also accident insurance coverage. Considered that most individuals plan to market higher-end models in the future, nonetheless, extensive and also collision insurance policy might be a necessity. Credit rating: Your credit history score shows just how reputable you are when it involves paying back lendings. insurance company.